Use Case - LAW Process Library

Law Firm Process Library

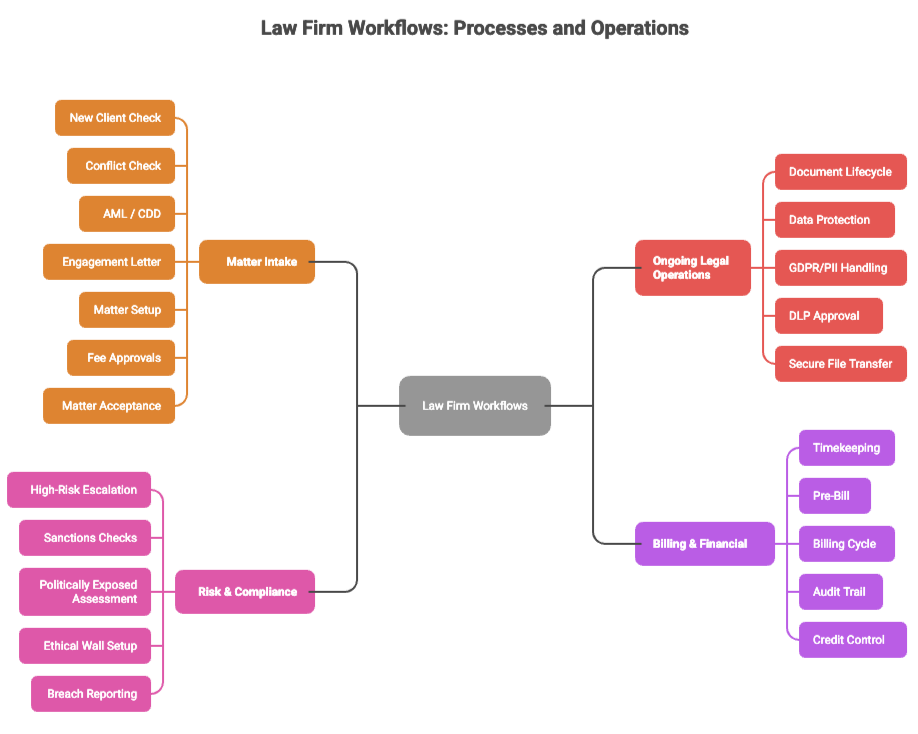

Matter Intake, Conflicts, AML, Legal Ops, Risk, Billing & Compliance

This library represents the full operational architecture of modern law firms — covering client onboarding, regulatory duties, conflict checks, file lifecycle, compliance, billing, data protection and high-risk matter governance. Built for international firms operating across multiple jurisdictions with strict SRA/ABA/DFSA/COFA/COLP oversight.

1. Matter Intake

Purpose: Prevent the firm entering into a relationship with unsuitable, prohibited or high-risk clients.

Workflow:

– Matter partner submits new client request in PMS/Intapp Intake

– Client name normalisation (aliases, trading names, corporate group)

– Check against internal databases (prior representations, conflicts record, closed matters)

– Preliminary risk screen: sanctions, PEP, adverse media

– Client classification: private individual / corporate / government / financial institution

– Jurisdictional review (prohibited/embargoed countries)

– Initial risk score assigned (low/medium/high)

Controls:

– Mandatory MLRO review for high-risk geographies

– Automatic blocks for embargoed entities

– Evidence stored in client onboarding record (audit ready)

Purpose: Comply with legal obligations to avoid conflicts of interest that could compromise independence or confidentiality.

Scope:

– Client conflicts

– Party conflicts

– Corporate family conflicts

– Past representations

– Confidentiality conflicts (Chinese Walls)

Conflict Check Steps:

– Conflicts team receives search terms (client, parent, subsidiaries, directors, counter-parties)

– System search across PMS, DMS, CRM and legacy systems

– Conflicts team logs all matches (positive/negative/partial)

– Partner reviews and provides context

– Ethical wall creation where required

– COLP sign-off for complex cases

Controls:

– Automated searches with alias matching

– Conflict waiver workflow for joint engagements

– Full audit trail

Purpose: Ensure all clients and relevant parties meet AML/CTF requirements across the jurisdictions in which the firm operates.

CDD Steps:

– Collect identity documents (individuals) / corporate filings (companies)

– Verify beneficial ownership (UBO/PSC checks)

– Sanctions, PEP, adverse media screening

– Employment/industry risk assessment

– Geography risk scoring

– Matter purpose assessment (nature of work, transaction type, counter-parties)

– EDD for high-risk clients: source of funds, source of wealth, business model review

Controls:

– MLRO review for high-risk cases

– Block matter opening until CDD complete

– Annual refresh for certain matter types (e.g. ongoing transactions)

Purpose: Define scope, fees, responsibilities, confidentiality and liability for each client engagement.

Workflow:

– Draft prepared by matter partner

– Standard clauses (confidentiality, liability caps, jurisdiction, billing terms)

– Conflict waiver integrated where applicable

– Client approval and signature

– Upload into DMS

– Link to matter record in PMS

Controls:

– Mandatory engagement letter before time entry allowed

– Automated reminders for missing letters

– Version-controlled templates maintained by GC team

Purpose: Create compliant matter structures in the Practice Management System for timekeeping, billing and reporting.

Steps:

– Client and matter codes created

– Workflows assigned (Litigation, Corp, Real Estate, Investigations)

– Billing structure attached (hourly, fixed, blended, contingency)

– Cost centres and reporting groups defined

– Fee earners assigned with rates

Purpose: Ensure non-standard fee arrangements are authorised and profitable.

Approval Types:

– Discounted rates

– Success fees

– Portfolio pricing

– Retainers

– Contingency agreements

– Alternative fee arrangements (AFAs)

Workflow:

– Partner submits fee proposal

– Finance reviews profitability modelling

– Pricing committee approval (for larger deals)

– Upload into PMS

Purpose: Ensure that the firm accepts only appropriate work, in line with capacity, expertise and regulatory expectations.

Criteria:

– Is the matter within expertise?

– Are there capacity/resource constraints?

– Are there red-flag risks (political exposure, sanctions adjacency, reputational risk)?

– Does the matter require COLP approval?

2. Ongoing Legal Operations

Purpose: Manage the full lifecycle of legal documents from drafting to archiving.

Stages:

– Drafting in DMS (iManage, NetDocs)

– Version control

– Partner/Client review cycles

– Secure collaboration and redlining

– Finalisation and execution (DocuSign)

– Retention and disposition per jurisdiction

Controls:

– Mandatory metadata classification

– Document access based on ethical wall rules

– Retention policies (5/7/10+ years depending on practice area)

Purpose: Ensure that all client and matter data complies with GDPR, CCPA and other privacy regimes.

Key Data Controls:

– PII identification and tagging

– Special category data handling (criminal, health, political beliefs)

– Data minimisation

– Client consent tracking

– Transfer risk assessments for cross-border transfers

– DPO review for sensitive matters

Purpose: Protect client PII and ensure firm-wide compliance with GDPR rights.

Responsibilities:

– Respond to data subject access requests

– Manage right-to-erasure requests

– Restrict access when required

– Maintain Article 30 ROPA records

Purpose: Prevent unauthorised data movement internally and externally.

DLP Controls:

– Email scanning for PII/privileged information

– Blocking/approval for external file sharing

– USB/block device restrictions

– Alerts to Security Operations team

– Approval workflow for exceptions

Purpose: Ensure sensitive matter files are shared securely with clients, counsel and regulators.

Workflow:

– Upload to secure workspace (ShareFile, HighQ, Kiteworks)

– Expiry rules for links

– Multi-factor authentication

– Access logging and anomaly detection

– Data room creation for large matters

3. Risk & Compliance

Purpose: Ensure serious compliance, political, reputational or financial risks are escalated.

Triggers:

– Representing sanctioned-adjacent clients

– Criminal defence with financial crime adjacency

– PEP clients

– Government or state-owned entities

– Media-sensitive matters

– Cross-border matters in high-risk jurisdictions

Escalation Chain:

Partner → Risk Team → MLRO → COLP/COFA → Board Risk Committee

Purpose: Prevent breaches of OFAC, UK HMT, EU and UN sanctions regimes.

Scope:

– Clients

– Counterparties

– Directors/officers

– Jurisdictions

– Payments under client accounts

Controls:

– Real-time sanctions updates

– Mandatory screening for every new matter

– Escalation to MLRO for close matches

Purpose: Ensure PEP clients receive heightened scrutiny.

Workflow:

– Identify PEP or RCA (close associate)

– Enhanced due diligence (SOW, SOF)

– Ongoing monitoring for changes

– MLRO sign-off before matter acceptance

Purpose: Protect confidentiality where conflicts exist but representation is allowed.

Implementation:

– Access control in DMS

– Segregated matter workspace

– Restricted personnel lists

– Automated monitoring for access breaches

Purpose: Manage internal and reportable compliance breaches.

Workflow:

– Staff reports breach (confidential channel)

– Risk team triage (minor/major/reportable)

– Investigation

– COLP/COFA notification

– Regulator submission if required

– Corrective action plan

4. Billing & Financial

Purpose: Ensure accurate, timely and compliant billing.

Workflow:

– Time entry by fee earners

– Automated validation rules (narrative quality, client restrictions)

– Pre-bill review by partner

– Adjustments (write-offs, write-downs)

– Final invoice issue

– Delivery through secure channels

Purpose: Maintain complete traceability for invoice edits.

Controls:

– Logs of every adjustment

– Reason codes for write-offs

– Partner approval for large adjustments

– COFA review for non-standard items

Purpose: Ensure receivables are collected promptly and disputes are escalated.

Steps:

– Invoice aging analysis

– Reminders and client chasers

– Partner escalation for overdue accounts

– Credit risk review for repeat offenders

– Hold on new matters if outstanding balances exceed limits

Services KYC / AML / Sanctions • Automation & RPA • Process Engineering • Regulatory Alignment • Governance & Controls • Operational Model Redesign

Sectors Financial Services • Banking • Global Law Firms • Regulated Gambling • Energy & Utilities • Enterprise & Public Sector

Resources Process Library • Case Studies • Compliance Frameworks • Insights & Research

Company About • Leadership • Careers • Contact • Security & Trust Center

Legal Privacy Policy • Terms of Service • Accessibility • Data Processing Agreement

Copyright © 2025 iaai.

All rights reserved. Operates globally under applicable regulatory and data protection frameworks..

At iaai, our mission is simple: to make AI more personal, accessible, and meaningful. Let’s transform the way you complete tasks