Use Case - KYC Process Library

Financial Services & Banking — KYC / KYB Onboarding

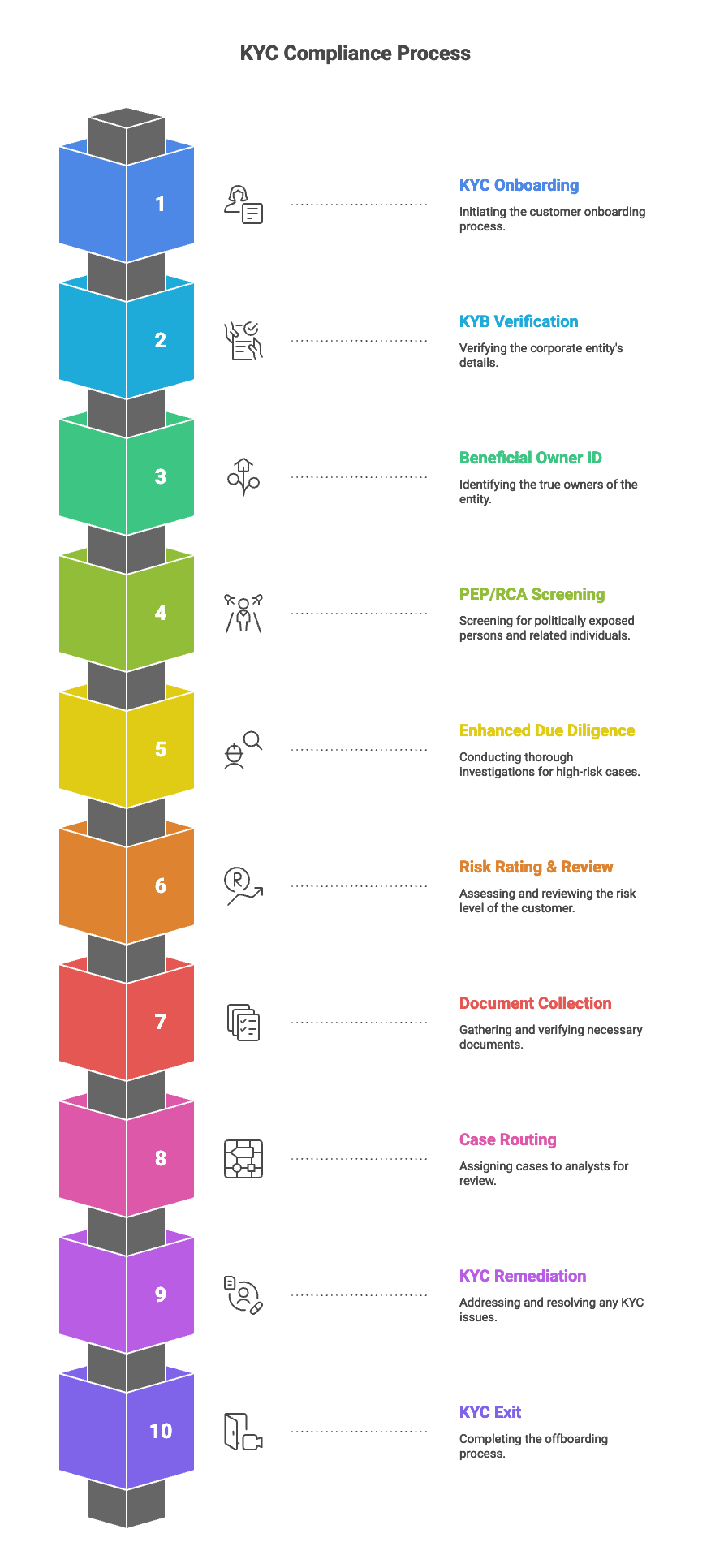

Full Lifecycle Processes

Purpose: Verify identity, assess financial crime risk, and produce a fully auditable onboarding record.

Includes:

– Application Intake

– IDV (document, biometric, liveness)

– Sanctions / PEP / RCA Screening

– Adverse Media Review

– Risk Scoring

– Document Collection

– EDD Where Required

– Case Routing

– Compliance Approval & Activation

Purpose: Confirm the legitimacy of business clients and establish beneficial ownership.

Includes:

– Corporate Registry Verification

– Active Status Check

– BO Mapping

– UBO Identity Checks

– PEP/RCA Screening

– Industry Risk Scoring

– Offshore / Shell EDD

– MLRO Approval

Mapping natural persons with direct/indirect control over legal entities using FATF, FCA, and EU AMLD6 definitions.

Includes:

– Ownership hierarchy analysis

– Control-based BO assessment

– >25% and >10% thresholds

– Screening of directors & UBOs

– MLRO escalation for complex cases

Real-time screening for politically exposed persons, their relatives, and close associates.

Includes:

– Hit identification

– False positive reduction rules

– Level 1/2 review

– Enhanced monitoring setup

– Compliance approval documentation

Deep due diligence procedures for high-risk individuals and entities.

Includes:

– Source of Wealth validation

– Adverse media deep-dive

– Jurisdictional analysis

– High-risk industry checks

– Senior approval workflow

– EDD evidence file

Application of customer risk scoring and assignment of review cadence.

Includes:

– Transaction profile analysis

– AML behaviour risk mapping

– Periodic review rules

– Triggered review (sanctions, adverse media)

Verification of identity, address, financial documents, corporate filings, and risk evidence.

Includes:

– OCR extraction

– Metadata validation

– Fraud detection flags

– Cross-registry verification

– Analyst evidence notes

– Compliance sign-off

Automated or manual assignment based on risk, complexity, and SLA requirements.

Routing:

– Low → Automated

– Medium → Analyst

– High → Senior Analyst

– PEP/Sanctions → Compliance

– Complex KYB → Specialist Team

Triggered updates due to expired documents, risk changes, or regulatory updates.

Includes:

– Outreach

– Doc refresh

– Re-screening

– Re-assessment

– Compliance review

– Evidence archive

Formal removal of customers who fail to meet compliance requirements.

Includes:

– Account freeze

– AML investigation

– SAR filing (if required)

– Customer notification

– Archive evidence

– Do-Not-Onboard flag

Services KYC / AML / Sanctions • Automation & RPA • Process Engineering • Regulatory Alignment • Governance & Controls • Operational Model Redesign

Sectors Financial Services • Banking • Global Law Firms • Regulated Gambling • Energy & Utilities • Enterprise & Public Sector

Resources Process Library • Case Studies • Compliance Frameworks • Insights & Research Company About • Leadership • Careers • Contact • Security & Trust Center

Legal Privacy Policy • Terms of Service • Accessibility • Data Processing Agreement

Copyright © 2025 iaai.

All rights reserved. Operates globally under applicable regulatory and data protection frameworks..

At iaai, our mission is simple: to make AI more personal, accessible, and meaningful. Let’s transform the way you complete tasks