Process Library

iaai currently use 6 Master Categories:

CATEGORY 1 — Financial Services & Banking Workflows

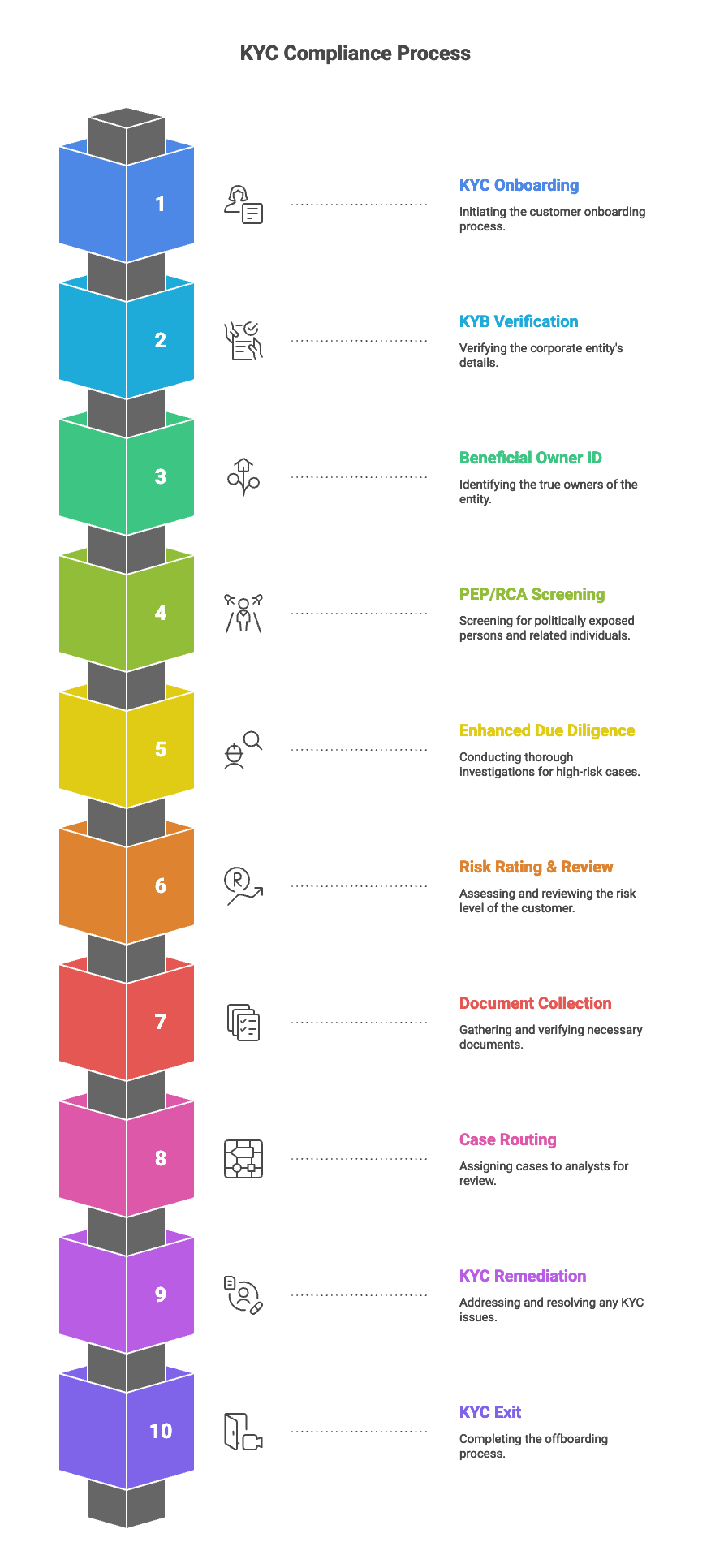

1. KYC / KYB Onboarding

KYC Initial Customer Onboarding Flow

KYB Corporate Entity Verification Flow

Beneficial Owner Identification

PEP / RCA Screening & Approval

Enhanced Due Diligence (EDD)

Risk Rating & Periodic Review Cycle

Document Collection & Verification

Case Routing & Analyst Assignment

KYC Remediation Cycle

KYC Exit & Offboarding Workflow

2. AML Investigations

Transaction Monitoring Alert Handling

Level 1 → Level 3 AML Escalation

AML Investigation Case Structure

Evidence Collection & Audit Trail

SAR Preparation & Filing

Post-SAR Customer Treatment

AML Quality Assurance Workflow

AML Model Governance Cycle

3. Sanctions & Screening

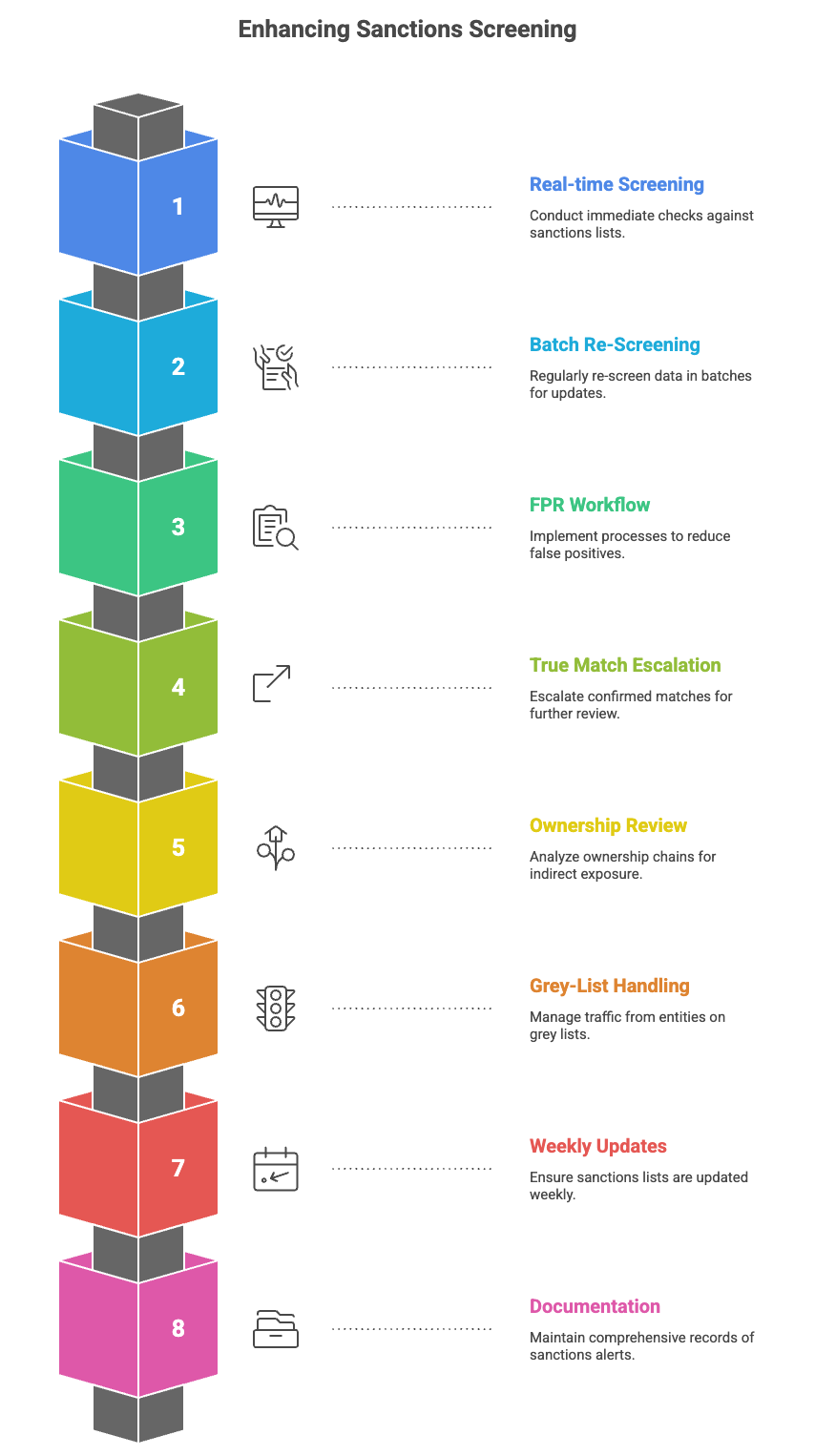

Real-time Sanctions Screening Flow

Batch Re-Screening Process

False Positive Reduction (FPR) Workflow

True Match Escalation (Level 2 Review)

Indirect Exposure / Ownership Chain Review

Grey-List Traffic Handling

Weekly List Updates Workflow

Sanctions Alert Documentation Requirements

4. Fraud Detection & Risk Operations

Fraud Alert → Triage → Case Workflow

Behavioural Analytics Exception Handling

Chargeback Handling Flow

Identity Fraud (IDV Failure) Handling

Account Takeover Workflow

Card Not Present Fraud Investigation

Internal Fraud Escalation Pathway

5. Credit & Underwriting

Credit Application Processing

Risk Decisioning Logic

Manual Underwriting Flow

Document Collection & Verification

Appeal & Exception Handling

Credit Limit Review Cycle

6. Customer Operations & Complaints

Complaints Intake → Routing → Response

Vulnerable Customer Identification Flow

FCA DISP Compliance Workflow

Regulatory Complaints Escalation

Complaint Closure & Assurance Review

CATEGORY 2 — Regulated Gambling Workflows

1. Player Onboarding & Verification

IDV → AML → KYC Flow

SOF (Source of Funds) Verification

SOW (Source of Wealth) Review

Player Risk Rating Assignment

Data Enrichment Workflow

Failed Verification → Next Steps

2. Safer Gambling Workflows

Marker of Harm Detection

Automated Behavioural Flagging

Manual Review Flow

Player Conversations & Interventions

Temporary Restrictions Workflow

Permanent Exclusion Workflow

Regulatory Reporting & Evidence Capture

3. AML (Gambling-Specific)

AML Alert Handling

Transaction Pattern Analysis

AML Case Documentation

Interaction Requirements

High-Risk Customer Controls

Reporting to Regulator

4. Fraud & Risk

Bonus Abuse Workflow

Multi-Accounting Detection

Device & IP Risk Scoring

Payment Fraud → Triage → Case

Suspicious Activity Escalation

🟣 5. VIP & High-Value Players

VIP Eligibility Assessment

Enhanced Due Diligence (EDD)

Responsible Gambling Monitoring

Ongoing Compliance Review

CATEGORY 3 — Law Firm Workflows

1. Matter Intake

New Client Check

Conflict Check

AML / CDD for Clients & Parties

Engagement Letter Workflow

Matter Setup in PMS

Fee Structure Approvals

Matter Acceptance Governance

2. Ongoing Legal Operations

Document Lifecycle Workflow

Data Protection Workflow

GDPR/PII Handling

DLP (Data Loss Prevention) Approval Path

Secure File Transfer & Review

3. Risk & Compliance

High-Risk Matter Escalation

Sanctions Checks for Legal Clients

Politically Exposed Client Assessment

Ethical Wall Setup

Breach Reporting Workflow

⚖️ 4. Billing & Financial

Timekeeping → Pre-Bill → Billing Cycle

Audit Trail for Adjustments

Credit Control Workflow

CATEGORY 4 — Energy & Utilities Workflows

1. Field Operations

Maintenance Request Workflow

Permit to Work

Site Safety Checklists

Field Incident Escalation

Equipment Failure Investigation

2. Regulatory & Compliance

Environmental Incident Reporting

Audit Preparation Cycle

Risk Assessment & Mitigation

ESG Reporting Workflow

3. Supplier & Contractor Management

Supplier Onboarding

Supplier Risk Assessments

Contract Compliance Review

CATEGORY 5 — Cross-Industry Automation Workflows

1. AI-Powered Document Automation

Document Intake → Classification → Extraction

Accessibility Remediation Workflow

Privacy & Security Scanning

Tagging → Structuring → QA

Exception Handling

Human-in-the-loop Approval

2. RPA Automation

Trigger → Bot Execution → Audit Logging

Error Handling Workflow

BOT QA & Release Management

CATEGORY 6 — Governance, Controls & Operating Models

1. Control Frameworks

1st/2nd/3rd Line Workflow

QA → QC → Audit Trail

Evidence Pipeline

Risk Scoring Engine Flow

2. Operating Model Design

RACI → Process → Controls Mapping

Policy to Procedure Flow

Governance Oversight Cycle

PHASE 2 — BEGINNING THE DETAILED LIBRARY CONTENT

PROCESS 1: KYC Onboarding Workflow (Full Detail)

Purpose

To onboard individual customers while meeting regulatory, risk, and compliance expectations for identity verification and financial crime controls.

Primary Stakeholders

KYC Analyst

Compliance

Operations

Risk

Relationship Manager

Automation Systems

Screening Vendors

High-Level Stages

Customer Application Intake

Identity Verification (IDV)

Sanctions / PEP Screening

Risk scoring

Document Collection

Enhanced Due Diligence (if triggered)

Approval / Decline

Customer Activation

Audit & Evidence Logging

Detailed Stage Breakdown

1. Application Intake

Customer submits application through onboarding flow

Personal information captured

System triggers IDV provider (OCR, biometric, validation checks)

Failure logic: Retry → Manual Review → Reject

2. Identity Verification

ID document authenticity checks

Liveness detection

Face match algorithms

Additional triggers: mismatched data → manual check

3. Screening

Real-time screening for:

PEP

RCA

Sanctions lists

False positive reduction

Hit categorisation (Level 1, Level 2)

4. Risk Scoring

Automated risk score based on:

Geography

Occupation

Behaviour models

Device intelligence

Customer profile

5. Document Collection

Request bank statements / proof of address / financial documents

Automation extracts key fields

Exceptions routed to analysts

6. Enhanced Due Diligence

Triggers include:

High-risk country

Adverse media

Wealth inconsistency

Sanctions match

EDD steps:

Deeper document checks

Source of wealth review

Senior Management escalation

7. Approval / Decline

All steps logged

Evidence files packaged

Compliance sign-off

8. Activation

Customer record created

Access enabled

Ongoing monitoring triggers registered

9. Audit Trail

Full documentation

Screening snapshot

Analyst notes

EDD evidence archive

Policy references

Financial Services & Banking — KYC / KYB Onboarding

Full Lifecycle Processes

Purpose: Verify identity, assess financial crime risk, and produce a fully auditable onboarding record.

Includes:

– Application Intake

– IDV (document, biometric, liveness)

– Sanctions / PEP / RCA Screening

– Adverse Media Review

– Risk Scoring

– Document Collection

– EDD Where Required

– Case Routing

– Compliance Approval & Activation

Purpose: Confirm the legitimacy of business clients and establish beneficial ownership.

Includes:

– Corporate Registry Verification

– Active Status Check

– BO Mapping

– UBO Identity Checks

– PEP/RCA Screening

– Industry Risk Scoring

– Offshore / Shell EDD

– MLRO Approval

Mapping natural persons with direct/indirect control over legal entities using FATF, FCA, and EU AMLD6 definitions.

Includes:

– Ownership hierarchy analysis

– Control-based BO assessment

– >25% and >10% thresholds

– Screening of directors & UBOs

– MLRO escalation for complex cases

Real-time screening for politically exposed persons, their relatives, and close associates.

Includes:

– Hit identification

– False positive reduction rules

– Level 1/2 review

– Enhanced monitoring setup

– Compliance approval documentation

Deep due diligence procedures for high-risk individuals and entities.

Includes:

– Source of Wealth validation

– Adverse media deep-dive

– Jurisdictional analysis

– High-risk industry checks

– Senior approval workflow

– EDD evidence file

Application of customer risk scoring and assignment of review cadence.

Includes:

– Transaction profile analysis

– AML behaviour risk mapping

– Periodic review rules

– Triggered review (sanctions, adverse media)

Verification of identity, address, financial documents, corporate filings, and risk evidence.

Includes:

– OCR extraction

– Metadata validation

– Fraud detection flags

– Cross-registry verification

– Analyst evidence notes

– Compliance sign-off

Automated or manual assignment based on risk, complexity, and SLA requirements.

Routing:

– Low → Automated

– Medium → Analyst

– High → Senior Analyst

– PEP/Sanctions → Compliance

– Complex KYB → Specialist Team

Triggered updates due to expired documents, risk changes, or regulatory updates.

Includes:

– Outreach

– Doc refresh

– Re-screening

– Re-assessment

– Compliance review

– Evidence archive

Formal removal of customers who fail to meet compliance requirements.

Includes:

– Account freeze

– AML investigation

– SAR filing (if required)

– Customer notification

– Archive evidence

– Do-Not-Onboard flag

Services KYC / AML / Sanctions • Automation & RPA • Process Engineering • Regulatory Alignment • Governance & Controls • Operational Model Redesign

Sectors Financial Services • Banking • Global Law Firms • Regulated Gambling • Energy & Utilities • Enterprise & Public Sector

Resources Process Library • Case Studies • Compliance Frameworks • Insights & Research Company About • Leadership • Careers • Contact • Security & Trust Center

Legal Privacy Policy • Terms of Service • Accessibility • Data Processing Agreement

Copyright © 2025 iaai.

All rights reserved. Operates globally under applicable regulatory and data protection frameworks..

At iaai, our mission is simple: to make AI more personal, accessible, and meaningful. Let’s transform the way you complete tasks